Growing annuity formula excel

Capital Gain Formula Example 3. You can also calculate a growing annuity with this future value calculator.

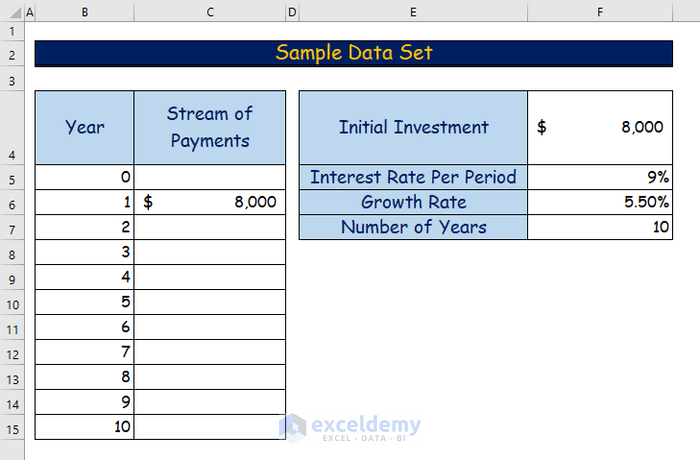

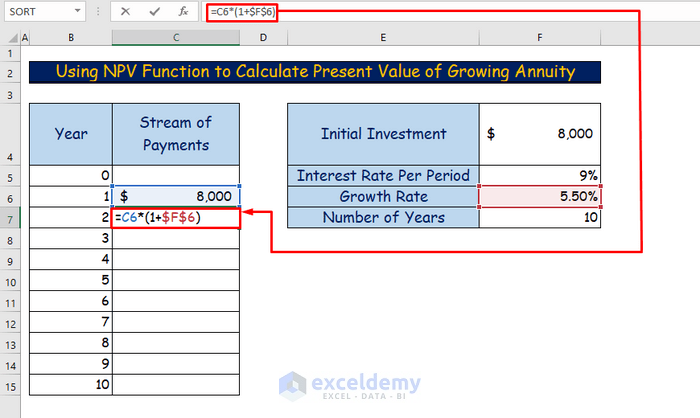

How To Calculate Growing Annuity In Excel 2 Easy Ways

The Synergy Valuation Excel Model enables you with the beta pre-tax cost of debt tax rate debt to capital ratio revenues operating income EBIT pre-tax return on capital reinvestment rate and length of growth period to compute the value of the global synergy in a merger.

. For instance on Excel if you go to the Formulas tab then the Financial tab you can click FV to. The best long term indicators Ive found of equity performance Shillers 10 yr adjusted PE GMOs formula for 7 yr returns or the following 5 yr returns based on current real interest rates which use different inputs point to real equity returns in the 2 to 4 percent range for the next 5-10 years. If you know your way around a graphing calculator you can work out an investments future value by hand using the equations above.

Excel can perform complex calculations and has several formulas for just about any role within finance and banking including unique annuity calculations that use present and future value of annuity formulas. Get 247 customer support help when you place a homework help service order with us. Over time a growing amount of each monthly payment goes toward principal.

Typically the debt incurred by the company is compared to metrics related to cash flow assets and total capitalization which collectively help gauge the companys credit risk. What is a Leverage Ratio. The present value of a growing annuity formula is.

PE Ratio of Apple Inc is Calculated Using Below Formula. Annual percentage rate divided by number of payments per year nper is the total number of payments pmt is the amount of payment fv is an optional argument allowing us to specify if there is any. NPV Net Present Value Formula Meaning Calculator Updated on.

Present Value of Growing Perpetuity Year 1 Cash Flow Discount Rate Growth Rate Present Value PV of Perpetuity Excel Template. Examples of Profitability Ratios Formula With Excel Template Profitability Ratios Formula. Returns the interest rate per period of an annuity.

Examples of Exponential Growth Formula With Excel Template Lets take an example to understand the calculation of. We will guide you on how to place your essay help proofreading and editing your draft fixing the grammar spelling or formatting of your paper easily and cheaply. Profitability as its name suggests is a measure of profit which business is generating.

Perpetuity Formula in Excel With Excel Template Perpetuity Formula. We know those income statement formulas are key parameters in analyzing the performance of any company but their drawback is that. X Number of time intervals that have passed.

It is very easy and simple. 59955 monthly payment - 499 interest in month three 10055. Where rate is the periodic interest rate ie.

Returns the cumulative interest paid on a loan between a starting period and an ending period. Excel can be an extremely useful tool for these calculations. A Leverage Ratio measures a companys inherent financial risk by quantifying the reliance on debt to fund operations and asset purchases whether it be via debt or equity capital.

Let us take the example of Walmart Incs stock price movement in the last one year. Future Value Growing Annuity Formula Derivation. Must contain at least 4 different symbols.

Now we can move on to an example present value PV calculation of perpetuities with varying growth rates. With our money back guarantee our customers have the right to request and get a refund at any stage of their order in case something goes wrong. In a growing annuity each payment after the first is increased by a factor g such that.

Perpetuity can be termed as a type of annuity which gets an innumerable amount of periodic payment. Net Profit Margin 90913600 2942425700 100. Profitability Ratios Formula Table of Contents Profitability Ratios Formula.

You need to provide the two inputs ie. You can easily calculate the PE Ratio using Formula in the template provided. These loan amortization schedules excel and amortization schedules with fixed monthly payment and balloon excel can be made manually or with the help of software.

Calculates the payment for a loan based on constant payments and a constant interest rate. The schedule that records the amount of interest and principal value for each debt and the details of the installation period is called an amortization schedule. 2What are the present worth and the accumulated amount of a 10 year annuity paying P10000 at the end of each year with interest at 15 compounded.

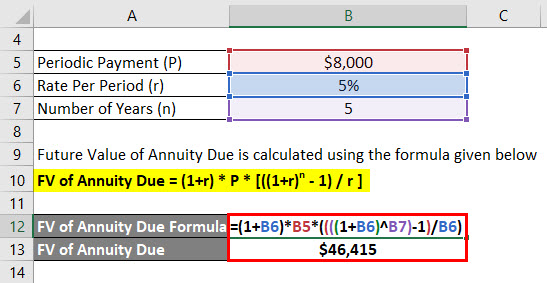

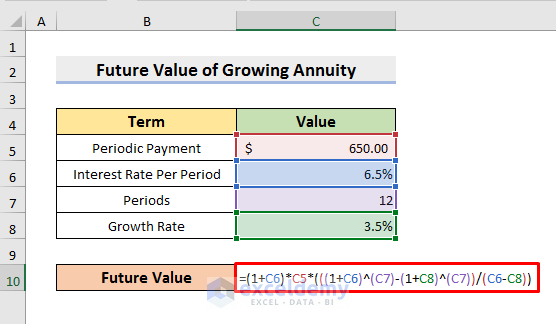

In a growing annuity each resulting future value after the first increases by a factor 1 g where g is the constant rate of growth. Where the following integers can be stated as-a Initial growth the amount before measuring growth or decay. If payments are at the beginning of the period it is an annuity due an we set T 1.

R Growth or Decay rate most often represented as a percentage and expressed as a decimal. You can also use an online future values calculator or run the formula on spreadsheet software like Excel or Google Sheets. ASCII characters only characters found on a standard US keyboard.

The same calculation can be conducted using Excel PV functionPV function syntax is PVrate nper pmt fv type. Modifying equation 2a to include growth we get. Formula for an Annuity Due 121 Growing Cash Flows 121 46 Using an Annuity Spreadsheet or Calculator 126 47 Non-Annual Cash Flows 128 48 Solving for the Cash Payments 129 49 The Internal Rate of Return 132 USING EXCEL Excels IRR Function 135 Appendix Solving for the Number of Periods 145.

Net Profit Margin 309 Things to Remember. HM Treasury is the governments economic and finance ministry maintaining control over public spending setting the direction of the UKs economic policy and working to achieve strong and. Excel provides a variety of worksheet functions for working with amortizing loans.

To get started fill out the form below to access the Excel file. Determine present worth and the accumulated amount of an annuity consisting of 6 payments of P120000 each the payment is made at the end of each year Money is worth 15 compounded annually. Perpetuity Formula Table of Contents Perpetuity Formula.

Present Value Growing Annuity Formula Derivation. May 11 2021 - 053016 PM. The basic annuity formula in Excel for present value is PVRATENPERPMT.

X Research source Calculate the principal payment in month three. If Lucy purchased 500 shares of Walmart Inc. The Net Present Value NPV is a method that is primarily used for financial analysis in determining the feasibility of investment in a project or a business.

Similar to Excel formulas If payments are at the end of the period it is an ordinary annuity and we set T 0. Here we will do the same example of the PE Ratio formula in Excel. It is the present value of future cash flows compared with the initial.

On 26 October 2018 for 9894 per share and then sold all the shares on 25 October 2019 for 11904 per share Calculate the capital gain earned by her in selling these 500 shares. 6 to 30 characters long. On the other hand an annuity typically means a consistent payment against a financial instrument.

Market Price of Share and Earnings per Share.

Excel Formula Payment For Annuity Exceljet

Future Value Of Annuity Due Formula Calculator Excel Template

How To Calculate Growing Annuity In Excel 2 Easy Ways

Graduated Annuities Using Excel Tvmcalcs Com

Present Value Of A Growing Annuity Formula Double Entry Bookkeeping

How To Calculate Future Value Of Growing Annuity In Excel

Growing Annuity Formula With Calculator Nerd Counter

Future Value Of An Increasing Annuity Youtube

Present Value Of A Growing Annuity Calculator Double Entry Bookkeeping

Graduated Annuities Using Excel Tvmcalcs Com

Calculating Pv Of Annuity In Excel

Present Value Of A Growing Annuity Formula With Calculator

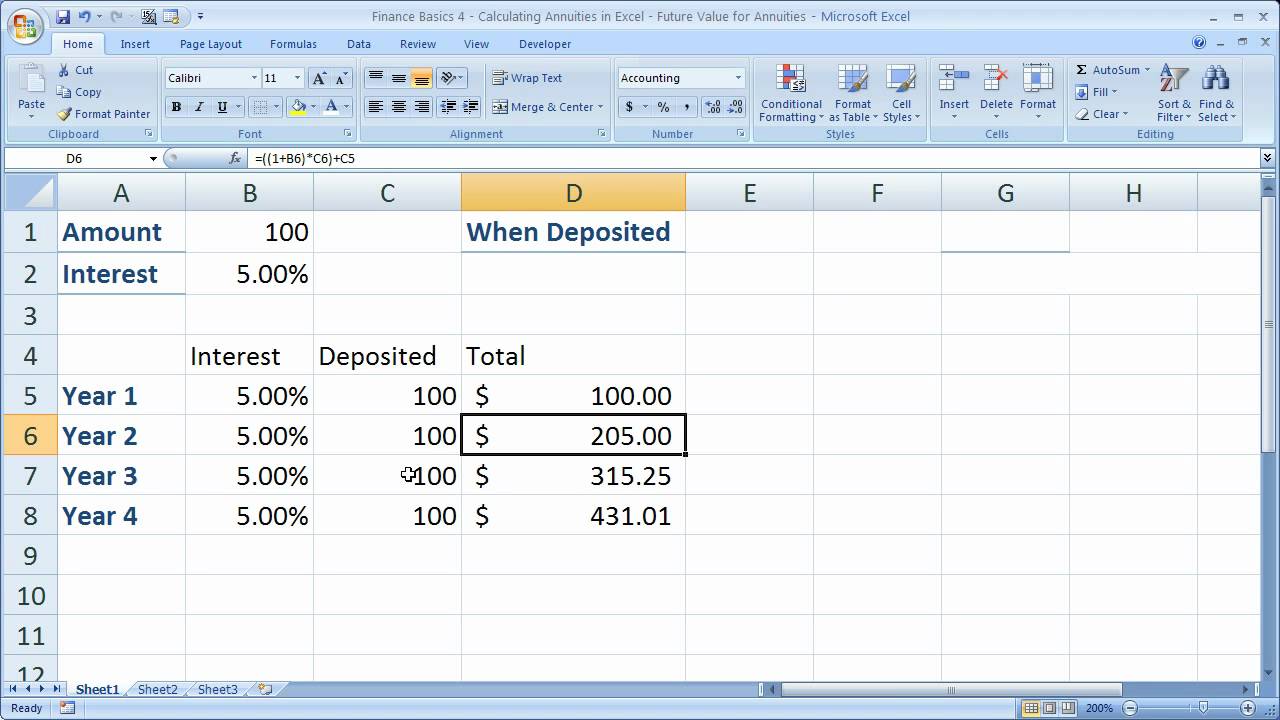

Finance Basics 4 Calculating Annuities In Excel Future Value For Annuities Youtube

How To Calculate Future Value Of Growing Annuity In Excel

Future Value Of A Growing Annuity Formula Double Entry Bookkeeping

Excel Formula Present Value Of Annuity Exceljet

Excel Formula Future Value Of Annuity Exceljet